Arctic15, June 5-6 Helsinki

“Arctic15 is focused on creating real value through connecting international investors, corporations, and startups.”

“The center of the conference is not the speakers on stage as at so many, but relationship building. People just kept chatting.”

“Largest startup event in Finland in the spring time, heavily focused on matchmaking and business connections.”

Arctic15, June 5-6 Helsinki

In 2019 the most effective networking startup conference in the Nordics and Baltics will raise the bar again.

“Arctic15 is focused on creating real value through connecting international investors, corporations, and startups.”

“The center of the conference is not the speakers on stage as at so many, but relationship building. People just kept chatting.”

“Largest startup event in Finland in the spring time, heavily focused on matchmaking and business connections.”

Arctic15 speakers

Scott is currently a director of Bloom Energy (NYSE: BE) and a number of private companies including Automation Anywhere, Branch, Cloudflare, Coursera, Enigma, Expanse (fka Qadium), Hello Alfred, One Concern, Robinhood, Sentons, Transfix, and WaterBit. Other previous investments include Fusion-io (acquired by SanDisk), Neoteris (acquired by Juniper Networks), NetIQ (acquired by Attachmate Corporation), Playdom (acquired by Disney), and Spreadtrum Communications (acquired by Tsinghua Unigroup).

Prior to joining NEA, Scott was a Product Manager at Microsoft, where he worked on Windows 95. Before joining Microsoft, Scott was the first salesperson at C-ATS Software and later co-founded and ran the company’s European subsidiary. He began his career at the Boston Consulting Group. Scott holds an MBA from Stanford and an AB in Engineering Sciences from Dartmouth College.

Scott also serves on the Board of Advisors for the Thayer School of Engineering at Dartmouth and is a former Chairman of the National Venture Capital Association (NVCA) (2014-2015).

#Investor

#CVC Track

Pratima Aiyagari joined Cisco Investments in 2011 and is responsible for investments and acquisitions in the EMEA region with a specific focus on ML/AI, Enterprise Collaboration and Silicon. In this role, she also serves as Cisco’s board observer on several portfolio companies. Prior to her current role, she has over a decade of experience in multiple roles as a Cisco engineer in the US (in the areas of network management, access routing and advanced services), sell-side equity research in Europe covering the TMT sector (at Société Générale) and corporate development at a startup.

Pratima received her MBA from INSEAD in France and an MS in computer science from the Virginia Polytechnic Institute and State University in the US. Pratima is a co-author of a US patent in the area of network device clusters and high availability.

Carolina focuses on fintech, digital health & wellness and marketplaces. Prior to joining Softbank, Carolina was a Partner at Atomico, where she sourced and collaborated with portfolio companies for almost five years. Some of her investments included Lendinvest, Gympass, Hinge Health, Ontruck and Rekki. Previously Carolina has worked as Head of Ops to a now defunct gifting e-commerce start-up, as an investor at Chicago-based private equity firm Madison Dearborn Partners and within Consumer/Retail Investment Banking at Merrill Lynch in New York.

Carolina has a Bachelor of Science degree in Foreign Service from Georgetown University and an MBA from Columbia Business School. She is originally from Brazil.

15 yrs., he was Chairman of Global Catalyst Partners, a global VC firm ($350M under management) with investments in the U.S., Japan, China, India, Israel and Singapore. Underlying his vision for global philanthropy is the conviction that modern Information and Communication Technologies (ICT) can be instrumental in dissolving barriers between nations and bridging the social and political differences among people. This vision was reflected in Schools-Online, a nonprofit he co-founded in 1996 to connect the world, one school at a time (6400 schools in 36 countries were provided with computers and access to the Internet) and merged with Relief International in 2003; Global Catalyst Foundation, co-founded in 2000 to improve lives through effective education and empowerment of the youth (with special emphasis on young women)

using the leverage of ICT, and UN-GAID, a United Nations global forum that promotes ICT in developing countries where he served as Co-Chairman (2009-2011).

He can be found at @HealthEugene or HealthEugene.com.

Before joining Facebook in 2014, Julia managed Developer Relations at Tapjoy, a mobile monetization platform.

Julia holds a first-class degree in Economics & Advertising from the University of Worcester.

15 industry-relevant tracks

100+ speakers participated in the event

Famous for effective networking

We optimize the matchmaking process beyond imaginable. Our networking area is open to everybody – be it a startup, an investor, a corporate partner, a journalist, a future employer or employee, or even a volunteer. That is the sole purpose of Arctic15 – to help you find the one and close that deal.

5000+ Meetings in Deal Room

In Deal Room, you get to meet, negotiate deals and receive feedback from your future investors, business partners and potential employees. Find the people you want to meet, pre-book meetings well in advance and have efficient 20-minutes long meetings on the spot. 40% of meetings in the Deal Room lead to real deals.

It’s a place to efficiently find new business opportunities in privacy and comfort.

5000 Meetings in 2 days

In Deal Room, you get to meet, negotiate deals and receive feedback from your future investors, business partners and potential employees. Find the people you want to meet, pre-book meetings well in advance and have efficient 20-minutes long meetings on the spot. 40% of meetings in the Deal Room lead to real deals.

It’s a place to efficiently find new business opportunities in privacy and comfort.

Access to 500 European Angels

Warm up for Arctic15 by starting your week with EBAN Helsinki 2019 Conference. Organized by Finnish Business Angels Network, the biggest and most active angel network in Europe, this event will offer plenty of opportunities for peer-to-peer networking and training sessions for angel investors.

Acquire your next LP

Brace yourself for the most influential LPs & GPs under one roof. Expect an insightful program and get ready for quality networking with relevant people, followed by a delicious culinary experience.

Investor-Investor Matching Tool

Connect with future investors, business partners or potential employees at our matchmaking area Deal Room, designed for effective networking in privacy and comfort. The Deal Room is a perfect platform to discover new business opportunities, share deal flow and enjoy insightful conversations in short 20-minute meetings.

Startup Dealflow

Less pitching, more matching. With optimised dealflow and filtering options, the Deal Room boasts the highest hit rate of matches, making it the most convenient investor-entrepreneur matching tool. Anticipating 500 startups from the Nordics & Baltics, you are invited to leverage this network of active professionals looking for opportunities.

M&A & Corporate Venturing

At the Exits track, you can anticipate fresh exit showcases and meaningful discussions about M&A. As Corporate Venturing is also one of the focuses at this year’s Arctic15, we will look into different models of Corporate Venturing, Nordic trends versus global trends, as well as how CVCs and VCs can blend.

Best Nordic Food

Arctic15 is known for many things, and the food is not an exception. We serve gourmet food which garner close-to-10 ratings each year. We are bringing you Nordic tastes from the top chefs of Finland, so brace your tastebuds!

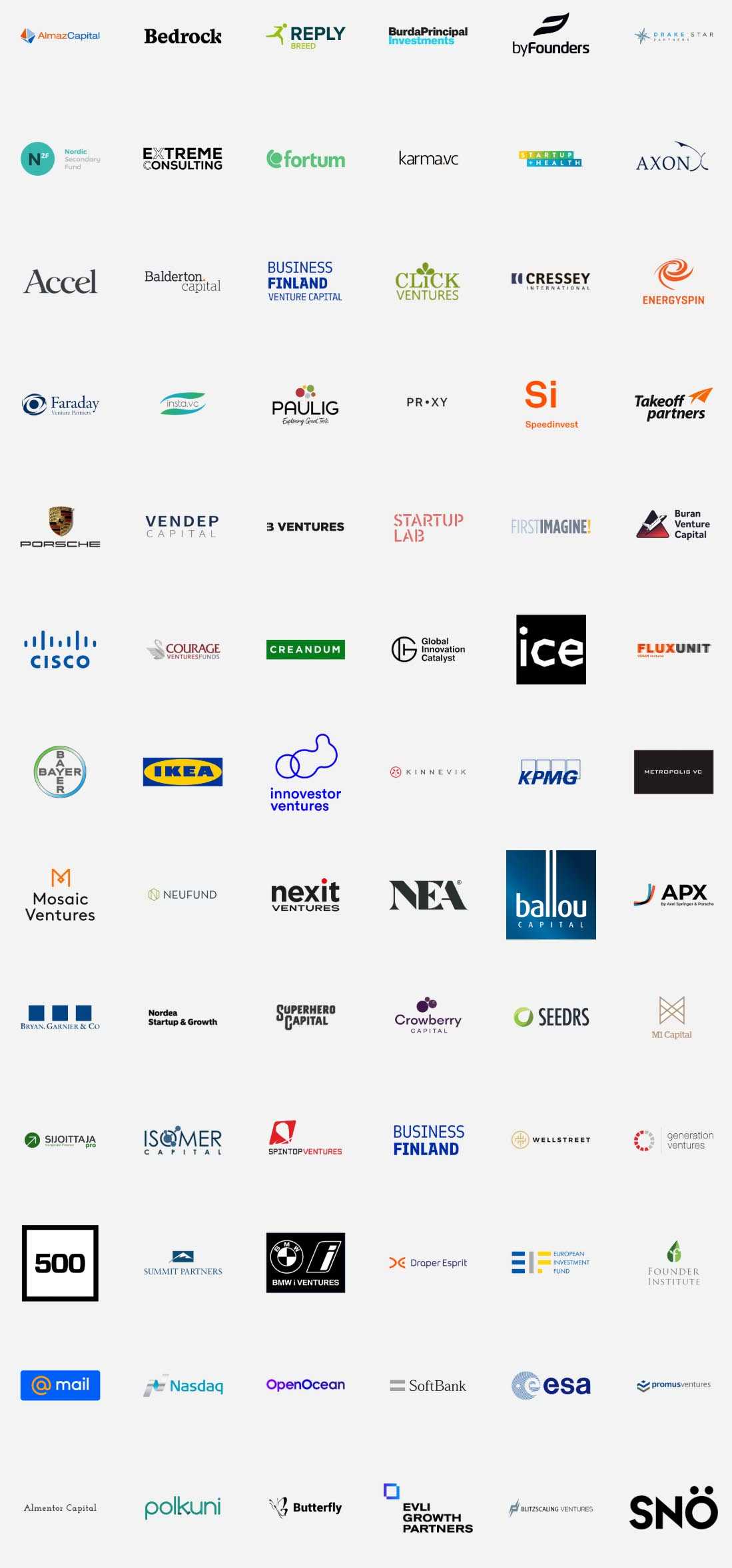

Previous investors

We match startups with investors

We believe that the best way we can help startups is by making it easier for them to close real deals. Be it with investors, partners, future employees or acquirers. That is the sole purpose of Arctic15 – to help you find the one and close that deal. We also look for the best startups for our investors and try to have only the relevant people in the room.

Top Investors

Over the years, we have consistently had one of the top investor to startup ratios of any startup conference in the world. With an expected 350 investors and 450 startups, this will also be the case in 2019. Because of this ratio, at Arctic15 – investors do not hide their badges, they are here to invest.

Partners

Arctic15 will also be a place that will gather a large amount of SME’s and corporations that will be looking for innovation. That is an opportunity for startups present at the event to not only find clients but potential long-term partners. Who knows, this might even lead to an acquisition. If it does – do tell.

Clients

At ArcticStartup, we strongly believe that it is revenues that drive businesses and not just investments. Therefore we hope that many of our startups will not be looking only for funding opportunities, but will also look for ways to make money during the two days at Arctic15.

Previous startups

Previous startups